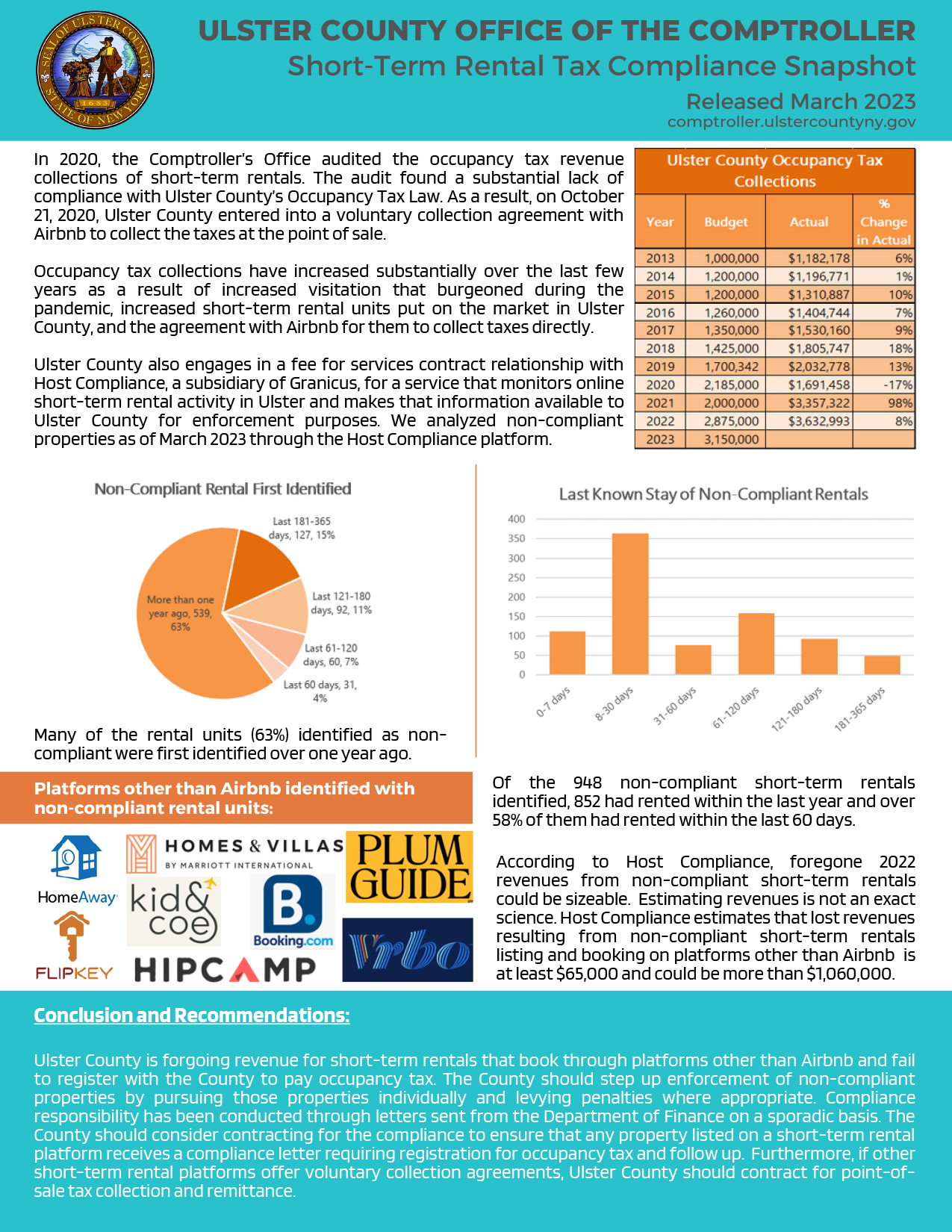

In 2020 the Comptroller’s Office audited the occupancy tax revenue collections of short-term rentals. The findings of the audit were that there was a substantial lack of compliance with Ulster County’s Occupancy Tax Law. As a result, on October 21, 2020, Ulster County entered into a voluntary collection agreement with Airbnb to collect the taxes at the point of sale. Occupancy tax collections have increased substantially over the last few years as a result of increased visitation that burgeoned during the pandemic, increased short term rental units put on the market in Ulster County, and the agreement with Airbnb for them to collect taxes directly. As of December 2022, the Comptroller’s Office found 994 short-term rentals identified by Granicus not registered to pay occupancy tax. Of the 994 non-compliant properties identified by Granicus, 74% or 738 of them were listed through Airbnb.