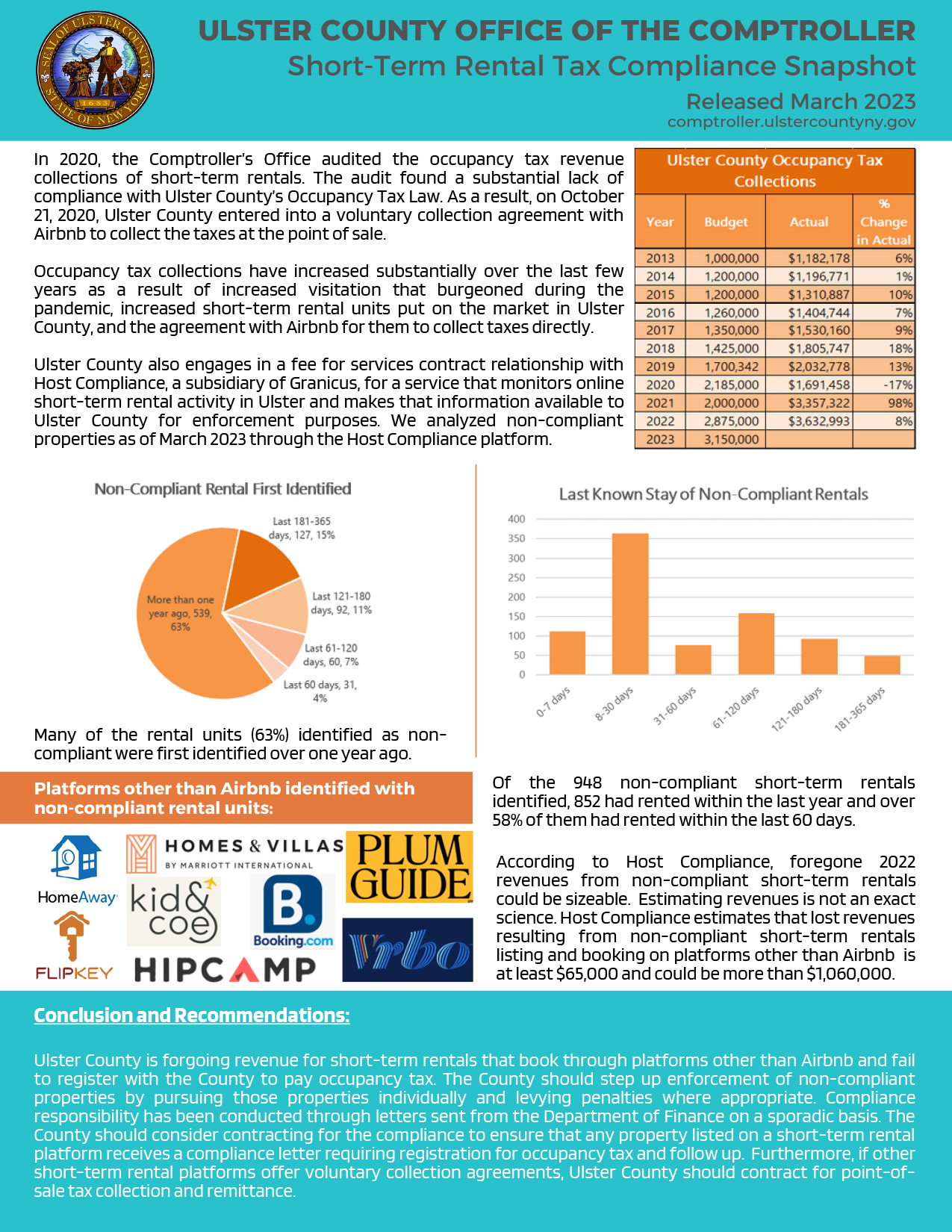

The Comptroller’s Office recently audited Ulster County occupancy tax from the largest taxpayers and those who claim exemptions. This audit did not cover occupancy tax revenue from short-term rentals. The County occupancy tax law allows taxpayers to claim an exemption when they have services or amenities included in the nightly room rate. When the Ulster County Legislature debated increasing the occupancy tax rate from 2 to 4% last year there was concern about the exemptions being claimed. As a result of those concerns, the County Executive requested this audit.

The audit identified more than $250,000 in recoverable occupancy tax revenues, some of which has now been paid. But the larger story here is that Ulster County has had lax oversight of occupancy taxes.

One large taxpayer failed to file returns or pay tax for over a year, and this was only identified through our audit. While operators were forthcoming, the audit found significant errors including misapplication of the exemptions, incorrect start date of the rate increase and failure to file altogether. Of the high-risk filers we reviewed a shockingly high percentage of taxpayers,36%, owed over a combined $250,000. With more than 500 businesses failing to file two consecutive returns, it’s possible that Ulster County could be missing out on significant revenue.

The reasons for this lack of enforcement are many including no formalized enforcement process, major turnover in the Department of Finance, antiquated systems that do not reconcile and lack of appropriate staffing. Ulster County will need to make investments in systems and staffing to address these issues.

Now that Ulster County has raised the tax rate, occupancy tax has become a more significant revenue source. With intention to dedicate 25% of occupancy tax revenues for housing and 25% for transportation, there is added incentive to ensure collections are enforced. As Ulster County faces federal budget cuts, we must prioritize revenue collection.