Ulster County Actual 2020 Sales Tax Within 1% of Budgeted Revenues Comptroller March Gallagher Calls for Transparency in State Sales Tax Diversions

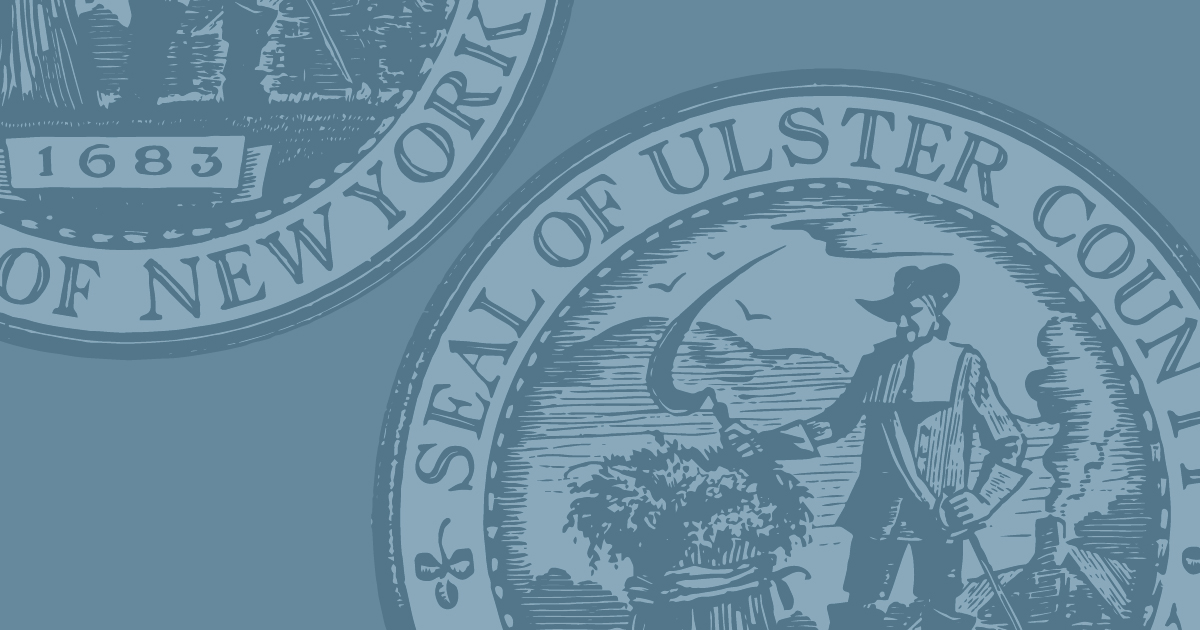

Kingston, NY (February 17, 2021) – Ulster County Comptroller today released a report on 2020 sales tax revenues. Ulster County received $127,282,741 in 2020 sales tax revenue which came within 1% ($1.28 million) of the $128,561,423 budgeted exceeding 2019 collections. Although the beginning of the pandemic impacted taxable sales in the March and April period, returns largely rebounded in the later months of 2020. The report also noted that the state diverted $1.52 million in 2020 from Ulster County revenues: $775,011 in Aid and Incentives to Municipalities (AIM-related) diversions and $744,543 in new Distressed Provider Assistance diversions. New York State plans to divert another $753,223 in Distressed Provider Assistance diversions in 2021 bringing the total two-year Distressed Provider Assistance totals up to $1.50 million.

“New York State is diverting sales tax revenue that counties rely upon to offset property taxes and provide services needed more than ever during the pandemic,” said Ulster County Comptroller March Gallagher. “The state has provided no transparency as to how the new Distressed Provider Assistance diversions will be allocated or used when they ought to be coming back to communities in need like ours. At a time when Ulster County residents have lost access to our inpatient mental health and detox beds at Health Alliance, these diversions are a slap in the face. While Health Alliance- and its parent company Westchester Medical- realize savings by cutting services, the cost has been transferred onto the backs of Ulster County families in gas, tolls, time and, most importantly, lives as some people do not get the care they need because of a lack of access.”

Analysis of taxable sales data for Ulster County shows some industries suffered more than others during the pandemic with Traveler Accommodations impacted the most at -43% in the March through November 2020 period compared to the same period in 2019. Restaurants and gasoline sales also declines, while grocery sales and building materials saw increases. Internet sales were up a remarkable +124% but the Comptroller’s Office cautioned that some of the increase were due to changes in the Marketplace Provider Law made in 2019.